By Rahul C Raju

http://www.vox-unpopuli.blogspot.com/“...Bachat Mera Adikar, Subhiksha Mera Abhiman…”

The Chennai based Food and Grocery retailer sprung up as a wonder kid in the Indian Retail scenario during the years 2007 and 2008 to gave every other retailer a run for their money through their aggressive expansion, ably supported by sky rocketing revenues. However, the retailer lost their Midas touch towards the last quarter of 2008 and Subhiksha now seems to be a prospective case study on ‘What Not to Do in Retail’.

Good Old Days

Subhiksha kicked off its pursuit in the emerging sector in March 1997 by opening their first store in Tiruvanmiyur, Chennai as a value focused Food and Grocery retailer. The founder, R Subrahmaniyam is an alumnus of IIT-M and IIM-A, the best pedigree one could ever desire in India. The maiden store of Subhiksha incorporated his insights from the market study, that if customers have to ditch their trusted neighbourhood stores for Subhiksha, they need to carry food and grocery at a price lower than the market price and make it available at a convenient location nearest to their customers. Thus, they pioneered value retailing in India, when organized retailing was meant for elite class.

Subhiksha kicked off its pursuit in the emerging sector in March 1997 by opening their first store in Tiruvanmiyur, Chennai as a value focused Food and Grocery retailer. The founder, R Subrahmaniyam is an alumnus of IIT-M and IIM-A, the best pedigree one could ever desire in India. The maiden store of Subhiksha incorporated his insights from the market study, that if customers have to ditch their trusted neighbourhood stores for Subhiksha, they need to carry food and grocery at a price lower than the market price and make it available at a convenient location nearest to their customers. Thus, they pioneered value retailing in India, when organized retailing was meant for elite class. Subhiksha started expanding rapidly by March 1999. In the next 15 months, they increased their number of stores from 14 to 50. By the end of 2002, the tally of Subhiksha stores in Tamilnadu stood at around 130. The rapid expansion spree of Subhiksha started in the second half of 2006, when they started to roll out stores one after another across the country. Subhiksha, which was a local player with approximately 150 stores till September 2006 increased their store numbers to more than 1600 (increase of roughly 1100%) by September 2008 to be India’s largest F&G retailer by number of stores, riding on the fresh private equity infused by I-Venture, the venture capital arm of ICICI. The revenue of the chain increased by nearly 700% during this period (Rs. 3.3 bn in FY06 to Rs. 23.05 bn in FY08). The growth of Subhiksha even attracted Azim Premji; a renowned Indian entrepreneur, to acquire 10% stake of the chain for Rs. 2.3 bn.

The trouble started trickling in by August 2008 when unconfirmed reports started dribbling in about the retailer not paying salaries to its staff and defaulting on rent. Towards the end of the year, most of its suppliers backed out from supplying to Subhiksha, owing to nonpayment of their previous dues. The subsequent events lead to a shameful low that the retailer had to ask its employees to take inventory from the store instead of salary!!! The battle for survival, however, did not last long and the cash starved retailer was forced to bid adieu to India retail sector (hopefully temporarily) by early 2009. The ignominy of the retailer aggravated with the revelation from the EPFO that the retailer had failed to remit the provident fund deductions to the PF trust from June 2008. The shameful turn of events was not yet over for retailer and it continued till the extend of its creditors vandalizing the shut stores in a couple of locations.

R. Subramanian, MD of Subhiksha Trading Services says that they need at least Rs 3 bn to re-start their business. Talks are still on about extending a CDR scheme to the retailer, but nothing seems to be turning the Subhiksha way. The reluctance from Kotak Mahindra Bank, one of the lenders of Subhiksha and the retailer’s disinclination to appoint KPMG as an independent auditor to audit their books of account (as suggested by ICICI) did not help the matter either. Though Deloitte is the official auditor of the retail chain, they have surprisingly failed to prepare the audited financials for FY08 and FY09.

November 14, 2009: Subhiksha has finally got a breather from the Supreme Court of India, as they granted a stay over the cases pending against the retailer in Madras high court including a host of winding up petitions filed by Kotak Mahindra Bank, Adlabs Films and HCL Infosystems. The case will again be taken up for hearing on November 23rd and then the retailer would have to convince the apex court with the formula which calls for 50% write off of the principal amount and a 10 year repayment period for the rest of amount.

What Went Wrong for Subhiksha

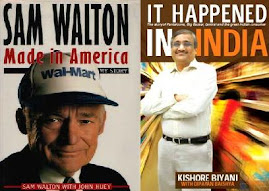

Subhiksha focused primarily on food and grocery, on which the net margin is as low as 1% - 2%. To sustain with FMCG, the retailer need to introduce in house brands/private labels, on which they can gain a margin of 13%. However, Subhiksha continued with selling the branded Food and Grocery items at this razor thin margin, without bothering much to introduce private labels. Subhiksha had private labels only in a handful of categories where national brands were absent. Surviving with this narrow margin is sustainable only if the retailer can generate high volume sales continuously. Would it be an inappropriate mention that almost all the retailers across the world, from Wal-Mart to India’s own Future Group and Reliance Retail are focusing on private labels to drive up their profit margins?

Subhiksha’s strategy of carpet-bombing their preferred location often lead to cannibalization of their own store’s customers. Though Mr. R Subramanian states that he would rather prefer to be cannibalized by his own store than losing the customers to another store, unconfirmed reports from the store managers of the retailer says that they often had to revise down their store targets even to an extend of lesser by 30%. Remember, Subhiksha had 157 outlets in Delhi as against the 110 post offices in the city!!!

Apart from F&G, another category to which Subhiksha diversified was mobile phone retailing. Though mobile phone sales can beef up the top line, it will not reflect much in the bottom-line as the net margin from mobile phone sales are a low 1% - 2%.

Subhiksha lost their plot significantly by going for a highly leveraged financial structure. Even a novice in financial management (like me) would certify that a Debt:Equity ratio of 1:.031 is far from desirable. The total debt of Subhiksha stood at Rs. 8 bn against the equity capital of Rs. 320 mn (face value). Though the heavy debt was not a worry when the economy was upbeat, problems started stirring up towards the latter part of 2008.

.jpg) Another issue, which troubled the retailer, was that they did not had any proper IT infrastructure to back up their aggressive growth. Supply chain worries stalked Subhiksha right from the day they started expanding aggressively against consolidating. By the time, they initiated SAP implementation in their stores, it was pretty too late. Thanks to this, customers were often greeted by empty shelves and continuous stock outs. This, coupled with the un-trained staff of Subhiksha alienated the customers from the retailer. This proved too costly for the retailer who banked upon high volumes for sustenance.

Another issue, which troubled the retailer, was that they did not had any proper IT infrastructure to back up their aggressive growth. Supply chain worries stalked Subhiksha right from the day they started expanding aggressively against consolidating. By the time, they initiated SAP implementation in their stores, it was pretty too late. Thanks to this, customers were often greeted by empty shelves and continuous stock outs. This, coupled with the un-trained staff of Subhiksha alienated the customers from the retailer. This proved too costly for the retailer who banked upon high volumes for sustenance.The heavy interest burden, dried up equity funding and sky rocketed rentals caught the company in a classic cash flow riddle. The economic downturn across the globe worsened the plight of the retailer. Though Zash Investments floated by Azim Premji acquired 10% stake in the company, it was a secondary market transaction in which money went directly to ICICI.

What They Did Right

Subhiksha pioneered the concept of no-frills, deep discount stores in India. When all his counter parts began embracing shoppertainment by providing enviable ambience to the customers, Mr. R Subramanian dared to think different. He concluded through his market research that food and grocery purchase is not a shopping experience that a prospective customer will look forward. Rather, it is a routine purchase where customers would look for proximity, lower costs and quality than a posh ambience. Subhiksha launched non-AC stores when that was a stigma in organized retailing in the country.

They were the groundbreakers in the Indian Organized Retail, who decided to tap the bottom of the pyramid by offering products at prices lower than the market price. They reached at lower prices than the competitors by pruning luxuries like air conditioning from the store. These benefits were rendered to the customers in the form of better savings The savings on each purchases were printed on the bill, thus making the customers aware of the benefits of shopping at Subhiksha

Mr. R Subramanian also decided to limit his store’s sizes to around 1500 sq.ft. as the catchment area for no food and grocery store in India exceeded 5 kilometres. He clearly understood that what India needs is not ‘one stop shopping destinations’, but small sized stores nearer to the customers.

Subhiksha integrated their supply chain by sourcing their products directly from the manufacturers, thus eliminating the commission to intermediaries. They also used to pay for the sourcing in cash in order to avail cash discounts.

Subhiksha also challenged the ‘touch and feel’ factor when everyone else was shouting for experiential marketing. Mr. R Subramanian says touch and feel is an abuse word in food and grocery retailing. Resultantly, none of the Subhiksha outlets provided the luxury of touch and feel to its customers. While the customers placed their order through display terminals, delivery was wholly over the counter.

Conclusion

To be fair enough to the troubled retailer, Subhiksha is not just a story of what not to do in retailing. All the enterprising retailers can take a leaf out of the Subhiksha story to learn how to emerge as a winner by challenging the laid out norms. However, the striking lesson that can be learnt from the rise and fall of Subhiksha is not to get your basics wrong in retailing. Subhiksha’s failure to live up to the promise was not a failure of the business format which it pioneered, but some basic flows with capital structuring coupled with the greediness for mindless expansion and diversification.

A word of caution to all aspiring entrepreneurs: “Stop Wearing Your Tata/Ambani Hat and Conglomerating Your Business the Day You See Some Numbers in Your Bottom-Line, Rather Make Sure that the Company is Not Loosing Focus Due to its Diversification.”

------------------rahool…

Rahul C Raju, FO – 21

+91-9739-444-992

Acknowledgement

If I need to acknowledge someone for his/her assistance in finishing this article, it should be the trusted ‘Google’, for always coming up with relevant results whenever I typed in any search queries.

Webliography

http://nitinchandil.blogspot.com/

http://www.startupavenues.com

http://www.indiaretailbiz.com

http://www.mydigitalfc.com

http://www.business-standard.com

http://economictimes.indiatimes.com

http://www.bloombergutv.com

http://www.merinews.com

http://ibnlive.in.com

http://www.moneycontrol.com

http://trak.in

http://www.icmrindia.org

By Rahul C Raju

39 comments:

Hey Rahul,

The first post from ur batch is very good and informative.U did it in an odd style..Expecting many articles from u ppl...

Thank you Christy....

Hi All,

below is the first comment via email that i got for the post.

from Vishal Rami < visdip @ gmail.com>

sender time Sent at 8:51 PM (GMT+05:30). Current time there: 12:29. ✆

to 13.rahool@gmail.com

date 15 November 2009 20:51

subject Subhiksha

mailed-by gmail.com

Signed by gmail.com

Dear Sir,

But where is our two months salary.

Vishal Rami

Ahmedabad

+91-94278 56988

Sorry Vishal, I missed to mention that in the article. Subhiksha has committed one of the most terrible sins by not paying the salary of employees and as i have mentioned above, by not remitting the provident fund deductions to EPFO.

Subhiksha to re-open stores through franchise model

Posted On: 23-01-2010 00:00:00 10

Discount retailer Subhiksha, which shut all its stores almost a year ago, is attempting to revive a few of its stores in Chennai through a franchise model where the franchisees operate the stores under the Subhiksha brand at the front end while a Subhiksha team helps at the back end operations and sourcing. Instead of waiting for finances so it could open all its stores, the retailer has decided to start up three stores in Chennai under this franchisee model by early February in the localities of Triplicane, Ambattur and Tiruvanmiyur. The retailer is in the process of identifying franchisees that can help roll out more stores. Admitting that credit for the retailer's brand may be difficult at this stage, the franchisees will operate the stores and stocking on a cash basis to begin with. The stores will operate on the same discount model that Subhiksha grew its reputation on and will be developed on the tech platform the retailer was evolving before it was forced to shut down with a huge burden of debt.

Your blog keeps getting better and better! Your older articles are not as good as newer ones you have a lot more creativity and originality now. Keep it up!

And according to this article, I totally agree with your opinion, but only this time! :)

you have a wonderful site!

No matter what others say, I think it is still interesting and useful maybe necessary to improve some minor things

Hello,

Nice article written on Subhiksha store. it one of the top most stores of India. i did enjoyed reading your this article and also did get lots of good information from here. thanks for sharing such a good article. keep on posting such a good article.

snap frames

Thanks,

Nice article...Subhiksha seems to have been the classic example of a successful enterprise losing focus on the fundamentals due to diversification and expansion without increase in the underlying infrastructure.But as you point out,they challenged(successfully i might add) the way organised retailing was being done at that time.

Retailing is the transaction of goods between the seller and the end user as a single unit. Before knowing what is actual retail it’s important to know what is market and goods as well as the meaning of supply chain.

Post a Comment